Who Needs a TRN?

The TRN is needed to transact business with other institutions e.g. banks, schools, examination boards etc.

The number must be used when conducting business transactions with Tax Departments or Government Agencies.

Taxpayers (individuals and organisations) are required to register and receive a Taxpayer Registration Number by completing the relevant application form. Individuals will be required to complete an Application for Taxpayer Registration Number (Individuals) Form and return it to the Taxpayer Registration Centre or the nearest Collectorate with appropriate identification and documentation.

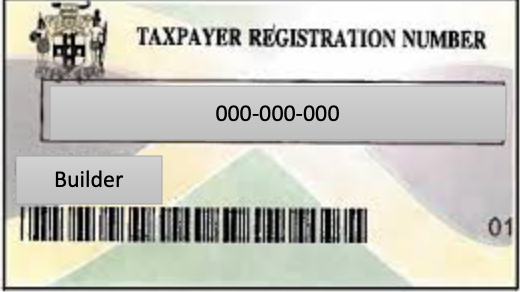

After registration of the taxpayer, a TRN is assigned to the taxpayer who is also issued with a TRN card in the case of an individual. A TRN card and a Registration Data Sheet are issued to an individual engaged in a trade, business or professional activity.

Organizations should complete an Application for Taxpayer Registration Number (Organizations) and submit same with the relevant documentation. A TRN Registration Certificate and Data Sheet will subsequently be issued upon assignment of a Confirmed TRN.

Share Now: