How to apply for a TRN in Jamaica from overseas

TAX ADMINISTRATION JAMAICA

- PCJ Building (4th Floor) 36 Trafalgar Road, Kgn 10

- 876-922-5905

- Toll Free: 888-GO-JATAX (USA)

- www.jamaicatax.gov.jm

- communications@taj.gov.jm

Step 1:

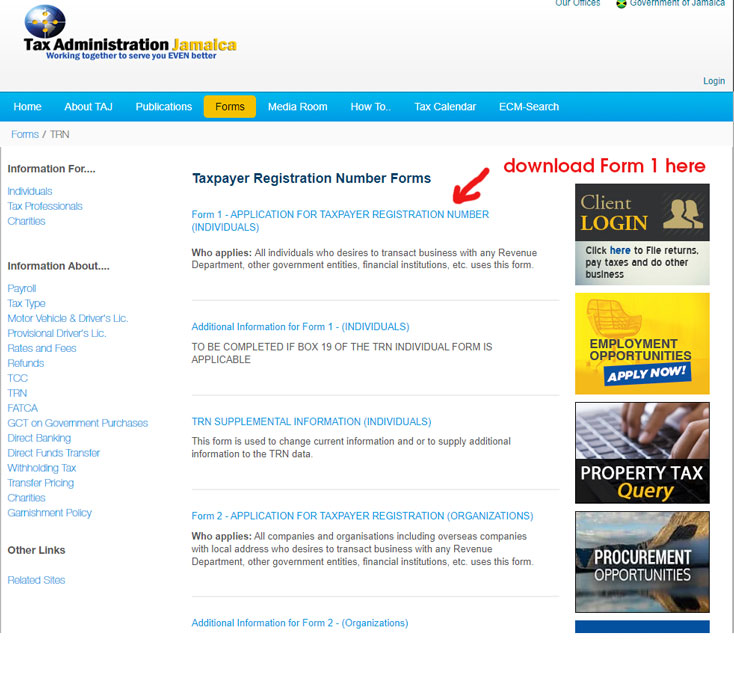

Visit the Tax Administration of Jamaica website at www.jamaicatax.gov.jm

Select forms from the menu near the top of the page – just below the logo

Scroll down to TRN in the drop down menu

Select and download Form 1:

Form 1 – APPLICATION FOR TAXPAYER REGISTRATION NUMBER (INDIVIDUALS)

Who applies: All individuals who desires to transact business with any Revenue Department, other government entities, financial institutions, etc. uses this form.

Step 2:

Complete, sign and mail the form with a notarised copy of your ID to:

Taxpayer Registration Centre

Tax Administration Jamaica (TAJ)

12 Ocean Boulevard

Kingston Mall

Jamaica

Or by Email: taxhelp@taj.gov.jm

What is a Taxpayer Registration Number or TRN?

In an effort to continue improving Tax Administration in Jamaica, the Government through the Tax Administration Reform Project (TaxARP) implemented the Taxpayer Registration System to facilitate the registration and assignment of the Taxpayer Registration Number or TRN.

TRN is a unique nine-digit identification number assigned to each individual taxpayer, business enterprise, organization (non-profit, partnership, charity, etc.) by way of an automated system.

Why TRN?

The TRN replaced the different numbers used by various Tax Departments such as Business Enterprise Number (BENO), Income Tax Reference Number, and effective November 2001, the Driver’s Licence Number. It also facilitates the Integrated Computerized Tax Administration System (ICTAS) for the Tax Departments

Who Needs a TRN?

The TRN is needed to transact business with other institutions e.g. banks, schools, examination boards etc.

The number must be used when conducting business transactions with Tax Departments or Government Agencies.

Taxpayers (individuals and organisations) are required to register and receive a Taxpayer Registration Number by completing the relevant application form. Individuals will be required to complete an Application for Taxpayer Registration Number (Individuals) Form and return it to the Taxpayer Registration Centre or the nearest Collectorate with appropriate identification and documentation.

After registration of the taxpayer, a TRN is assigned to the taxpayer who is also issued with a TRN card in the case of an individual. A TRN card and a Registration Data Sheet are issued to an individual engaged in a trade, business or professional activity.

Organizations should complete an Application for Taxpayer Registration Number (Organizations) and submit same with the relevant documentation. A TRN Registration Certificate and Data Sheet will subsequently be issued upon assignment of a Confirmed TRN.

Requirements for Application and Registration

When applying for a TRN, individuals, sole proprietors and the various types of organizations must submit specified documentation to support their application. It should be noted that only original and certified copies of documents are accepted. The required documentation for each type of applicant is outlined below.

Requirements for Individuals

Applications completed and signed should be submitted along with:

- Passport OR Driver’s License OR

- National ID/Voter’s ID, Work ID, School ID, professionally produced certified, passport size photograph or any other photographic ID MUST be used withBirth Certificate (and Marriage Certificate or Deed Poll if applicable)

- Self-employed persons need to submit their NIS card and If trade name is different from applicant’s name the Business Name Registration Certificateis needed

NB. Photographs must be certified by anyone of the following: Justice of the Peace, Minister of Religion/ Marriage Officer, Judge/ Resident Magistrate, Attorney-at-Law, Member of Parliament, Parish Councillor, Medical Doctor, School Principal, Civil Servant (SEG3 and above) or Police Officer at the rank of Inspector or above. Photographs must also be certified within the past six months to be acceptable.Certification should include the following: “certified to be a true photograph of ……………..,” name and title of Certifying Officer, Signature of Certifying Officer, date of certification, Official Stamp of certifying officer (not required for JPs). JPs should quote their assigned JP numbers

NB. Certified Photographs must be accompanied by a Declaration from the Certifying Official. The address on application must match the address on Declaration by Certifying Official. A blank declaration can be collected from your local Tax Office or be printed from Tax Administration Jamaica’s website www.jamaicatax.gov.jm

Requirements for Individuals (Submitting applications from overseas)

Applications completed and signed should be submitted along with:

- A copy of applicant’s Passport OR Drivers Licence (notarized by a Notary Public). Passport or Driver’s License must include the applicant’s name (full last and first name), date of birth, photograph and signature.

- If someone is being authorized to collect the TRN card an authorization letter from the applicant should be attached, stating the name of the person authorized to collect the card.

NB. TRN Cards for applicants who submitted their forms via mail from overseas will then be mailed to applicant’s address as stated on application. If the Identification or supporting documents are not in English, an official translated version is also required. The signature on the application form must match that on the Identification presented.

Application forms can be downloaded from: www.jamaicatax.gov.jm

Requirements for Minors (Persons Under 18 Years)

Applications for minors should be completed and signed and/or co-signed by either a parent or guardian.

Application signed by a parent should be submitted with the following:

- Child’s birth certificate

- Professionally produced, certified passport size photograph or picture identification for child

- Identification & TRN of the parent

NB. The birth certificate must show the name of the parent who signed the application.

Application signed by a guardian should be submitted with the following:

- Child’s birth certificate

- Professionally produced, certified passport size photograph or picture identification for child

- Identification & TRN of the guardian

- a. Court order verifying the legal guardian OR

b. Voluntary Declaration from the Guardian AND Voluntary Declaration from an Attestor (A person who knows of the Guardian/Child relationship)

NB. Photographs must be certified by anyone of the following: Justice of the Peace, Minister of Religion/ Marriage Officer, Judge/ Resident Magistrate, Attorney-at-Law, Member of Parliament, Parish Councillor, Medical Doctor, School Principal, Civil Servant (SEG3 or above) or Police officer at the rank of Inspector or above.Photographs must also be certified within the past six months to be acceptable.Certification should include the following: “certified to be a true photograph of…………….,” name and title of Certifying Officer, Signature of Certifying Officer, date of certification, Official Stamp of certifying officer (not required for JPs). JPs should quote their assigned JP numbers

NB. Certified Photographs for adults must be accompanied by a Declaration from the Certifying Official. Blank declarations can be collected from your local Tax Office or be printed from Tax Administration Jamaica’s website www.jamaicatax.gov.jm